Why is this important? Some of these questions may seem aggressive, yet they are in the context of the community and how they were asked.

The Tax Break-Down: The Low-Income Housing Tax Credit

- The low-income housing tax credit (LIHTC) provides an incentive for the development and rehabilitation of affordable housing.

- Created by the Tax Reform Act of 1986, these federal housing tax credits are awarded to developers of qualified projects via a competitive application process administered by state housing finance authorities (HFAs). Developers can use the credits or sell them to investors to raise capital for real estate projects.

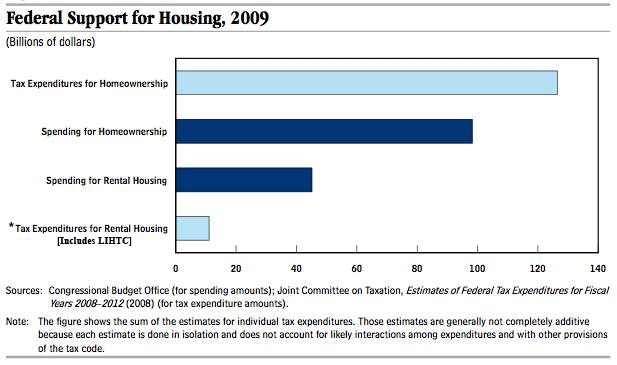

- Low Income People receive much less support than homeowners.

- In terms of overall federal support for housing, including rental housing homeownership, the LIHTC makes up only a small share of the resources. Data from the 2009 Congressional Budget Office shows that tax expenditures for rental housing (of which LIHTC comprises roughly half) were much smaller than federal support for home ownership and even spending on rental housing, as shown in the graph.